Using a fundamental investing principle could help many Australians bring their retirement forward.

It’s simple investing mathematics really. The more money you can save in investing fees, the more of your total returns you ultimately get to keep in your pocket.

In actual fact, investment fees (management and administrative fees, commissions and other costs) are the one thing in investing we can control.

And, when we’re talking about investing, don’t forget your superannuation fund is also charging you to invest your hard-earned retirement savings. They won’t hit your hip pocket directly, because super fees are generally deducted from the regular contributions made into your super account.

Alarmingly, Vanguard’s How Australia Retires study, released in May this year, found that one-in-two Australians don’t know how much they are paying in super fees, and two-in-five are unsure if their super fund is charging them low fees.

Australians are retiring later

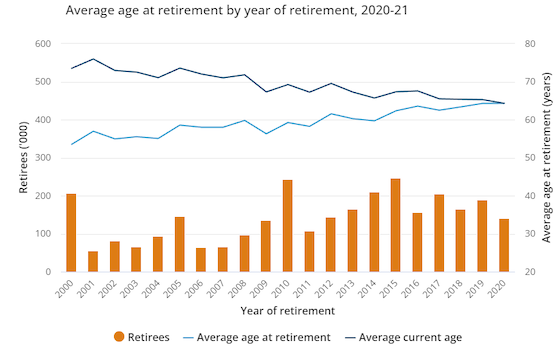

The Australian Bureau of Statistics’ latest Retirement and Retirement Intentions data covering the 2020-21 financial year, released at the end of August, shows that the average age of retirement has been steadily increasing over time. So is the average age that people intend to retire.

Of the total number of Australians who retired in 2020, the average age at retirement was 64.3 years. For men, the average age was 65.4 years and for women the average was 63.7 years.

That compares with 2000 when the average age at retirement was 53.5 years.

Source: Australian Bureau of Statistics

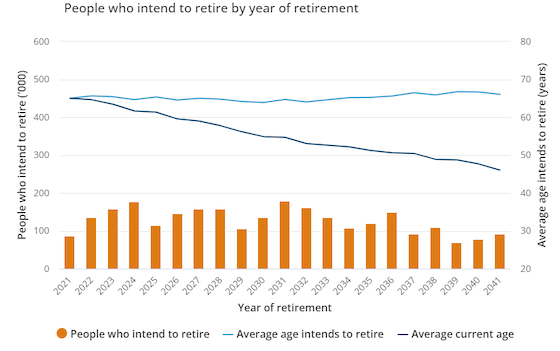

The average age when Australians intend to retire has also been creeping up over time. In 2020-21, when the latest ABS data was captured, it was 65.5 years. For men, the average intending to retire age was 66 years and for women the average was 64.9 years.

Source: Australian Bureau of Statistics

Tying costs to retirement age

There are a wide range of reasons why people earmark an intended retirement age. It can relate to financial reasons, lifestyle reasons, personal reasons, or a combination of all three.

One’s actual age of retirement may be the same as one’s intended age of retirement, but of course one’s circumstances can change and result in retirement being brought forward or pushed out.

Having the financial capacity to retire is a key reason why many people decide to retire earlier than they expected to.

This is where 2018 research by the Productivity Commission (Superannuation: Assessing efficiency and competitiveness) on the impact of superannuation investment costs has particular relevance.

The Productivity Commission’s analysis revealed a strong negative relationship between net returns and total fees – that is, funds with higher total fees on average deliver lower returns (net of administration and investment fees) for their members.

“The material amount of member assets in high-fee funds, coupled with persistence in fee levels through time, suggests there is significant potential to lift retirement balances overall by members moving, or being allocated, to a lower-fee and better-performing fund,” the Productivity Commission found.

“Fees have a significant impact on retirement balances. For example, an increase of just 0.5% a year in fees would reduce the retirement balance of a typical worker (starting work today) by a projected 12% (or $100 000).”

On a pure financial level, the benefits than can achieved by reducing super investment costs (the potential positive impact of doing so on one’s retirement balance) may be the catalyst for many Australians to bring their intended retirement age forward.

Source: Vanguard December 2023

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing™

General advice warning

This information has been prepared by Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263). We have not taken your objectives, financial situation or needs into account when preparing this information so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for any financial products before making any investment decision. Before you make any financial decision regarding Vanguard’s financial products, you should seek professional advice from a suitably qualified adviser. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This publication was prepared in good faith and we accept no liability for any errors or omissions.

2023 Vanguard Investments Australia Ltd. All rights reserved.